What is Indirect Cost and Why Project Managers Should Know About It

Explore what indirect costs are, how they differ from direct costs, and why project managers must take them into account when planning and managing projects.

Project managers are responsible for overseeing every aspect of a project, from its scope and timeline to its budget. While direct costs, such as raw materials, labor, and equipment, are often the focus, understanding indirect costs is equally crucial for successful project management.

Indirect costs are the expenses that support the project but can’t be directly attributed to any single task or deliverable. These include things like office space, utilities, administrative salaries, and insurance. Though they might seem less obvious, these costs can significantly impact a project’s overall budget and profitability.

In this article, we’ll explore what indirect costs are, how they differ from direct costs, and why project managers must take them into account when planning and managing projects. Whether you’re working on a construction site, overseeing an IT project, or managing a marketing campaign, keeping track of these hidden costs can make all the difference between a project’s success and failure.

What Are Indirect Costs?

Indirect costs are expenses that are necessary for the operation of a business or project but cannot be directly linked to a specific product, service, or task. Unlike direct costs, such as the raw materials or labor used to create a product, indirect costs are spread across various activities and support the overall functioning of the project or business.

These costs are often referred to as overhead costs because they support the general infrastructure rather than a particular project. For example, if you’re managing a project, the costs related to office space, utilities, and administrative staff might not directly contribute to producing the final deliverable, but they are essential for ensuring the project runs smoothly.

Some common examples of indirect costs include:

- Rent: The cost of leasing office space or a facility used by the project team.

- Utilities: Expenses like electricity, water, internet, and phone services that keep the business or project running.

- Administrative Salaries: Wages for employees who are not directly involved in the project but whose work is necessary for operations, such as HR or finance staff.

- Office Supplies: Items like pens, paper, computers, and software subscriptions that are used across multiple projects.

- Insurance: Coverage for the business or project that protects against risks but is not tied to any specific task.

While these costs aren’t directly involved in producing a specific output, they still contribute to the overall success and sustainability of a project. Understanding these costs is vital for accurate financial planning and ensuring that a project stays within its budget.

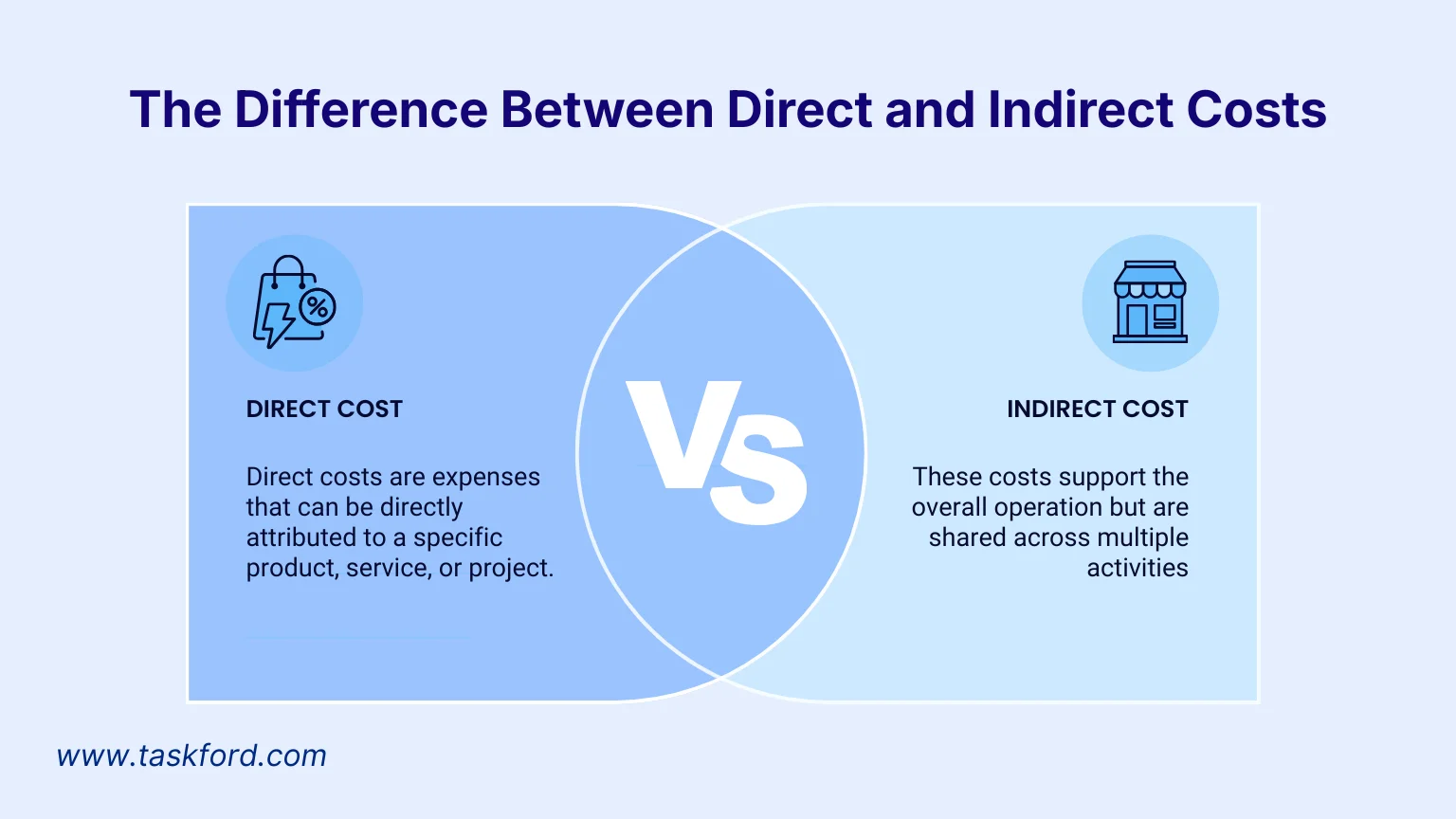

The Difference Between Direct and Indirect Costs

Understanding the distinction between direct costs and indirect costs is crucial for effective project cost management. Both types of costs play a role in your overall project budget, but they differ in how they are allocated and tracked.

Direct Costs vs Indirect Costs: Key Differences

Direct costs are expenses that can be directly attributed to a specific product, service, or project. These costs are directly involved in the production or delivery of the project’s output. For instance, if you’re managing a construction project, the materials used to build the structure (like cement, steel, and wood) are direct costs. Similarly, the wages of workers who are directly involved in construction, such as builders and laborers, are also considered direct costs.

On the other hand, indirect costs are not tied to a specific task or deliverable. These costs support the overall operation but are shared across multiple activities. For example, the salaries of administrative staff, office rent, and utility bills are indirect costs because they aren’t specific to any one project but are necessary for maintaining the business as a whole.

Examples of Direct Costs:

- Raw Materials: Materials used directly in the production process, such as fabric for a garment manufacturer or steel for a construction company.

- Labor Costs: Wages for workers directly involved in the project, such as machine operators, construction workers, or assembly line staff.

- Equipment: Costs for tools or machinery used specifically in the project.

How They Impact Budgeting and Project Planning

Both direct and indirect costs are critical to effective project planning and budgeting. Direct costs are relatively straightforward to account for because they are directly linked to project activities. These costs are often the focus of initial project budgets and cost estimates.

However, indirect costs can be more challenging to account for, as they are spread across multiple projects and activities. While they may seem less obvious, they can add up quickly and impact the total project cost. Without properly accounting for indirect costs, you risk underestimating the true cost of your project, which could lead to budget overruns or unexpected financial strain.

By understanding both direct and indirect costs, project managers can create a more accurate and comprehensive budget. This ensures that all necessary expenses are accounted for, reducing the risk of financial surprises down the line. Properly allocating indirect costs is especially important in multi-project environments, where shared resources and overhead costs need to be distributed fairly among different initiatives.

Why Project Managers Should Care About Indirect Costs

While direct costs like labor, materials, and equipment are often the primary focus for project managers, indirect costs play a crucial role in cost management and the overall success and financial health of a project. Indirect costs can significantly impact a project’s budget and profitability, so understanding them is essential for any project manager looking to keep things on track and within budget. In fact, a recent study, “Main Challenges in the Identification and Measurement of Indirect Costs in Projects: A Multiple Case Study” (2020), highlights the difficulties project managers face when identifying and allocating indirect costs effectively, which can lead to inaccurate cost projections and missed opportunities for cost optimization.

Here’s why project managers should care about indirect costs:

1. Accurate Budgeting

Indirect costs often account for a large portion of a project’s total expenses. If these costs are ignored or underestimated, it can lead to projects being underfunded, resulting in cost overruns or delays. By including indirect costs in the initial budget, project managers ensure that the budget is comprehensive and realistic, which helps prevent surprises later on. Properly accounting for these expenses is essential for maintaining financial control and preventing projects from going over budget.

2. Cost Allocation

In projects, indirect costs like administrative salaries, office space, and utilities need to be allocated across different project activities. Especially in larger organizations where multiple projects share common resources, a project manager needs to understand how to distribute these costs fairly. This ensures that no project is unfairly burdened with an excessive share of overhead costs, and it helps maintain accurate financial tracking across the board.

3. Profitability Analysis

Knowing both direct and indirect costs gives project managers a clearer picture of the total cost of delivering a project. This is vital for assessing profitability. By understanding how indirect costs affect the bottom line, project managers can make informed decisions about resource allocation, pricing strategies, and adjustments to ensure that the project meets its financial goals. It also helps project managers identify areas where they can improve cost efficiency without compromising the quality of the project.

4. Reporting and Forecasting

Indirect costs are often part of ongoing financial reporting and forecasting. If project managers can anticipate potential changes in these costs—such as a rise in overhead or administrative expenses—they can adjust project plans or budgets accordingly. This proactive approach ensures that the project remains on track financially, even when unexpected indirect costs arise. Adjusting forecasts in response to changes in indirect costs helps maintain overall profitability.

5. Client Communication

In certain industries, clients may need a clear breakdown of the costs associated with their projects, including both direct and indirect costs. Understanding how to communicate and justify the allocation of indirect costs is important for maintaining transparency and trust with clients. By properly explaining these expenses, project managers can avoid misunderstandings and ensure that clients understand the full scope of the financials behind the project. This is especially important when projects are billed on a cost-plus or fixed-price basis.

6. Compliance and Cost Control

In some cases, indirect costs may be subject to regulations or caps, particularly in government-funded projects or projects with specific contractual requirements. Project managers need to ensure that these costs are managed in compliance with the rules, which may include limits on overhead costs or specific reporting requirements. Effectively managing and reporting indirect costs helps project managers stay compliant with regulations and control costs effectively, reducing the risk of penalties or contract disputes.

Conclusion

In conclusion, indirect costs play a significant role in the financial success of any project, and understanding them is essential for project managers. These costs, which include expenses like rent, utilities, and administrative salaries, may not be as immediately obvious as direct costs, but they can quickly accumulate and impact the overall budget and profitability.

By properly accounting for and allocating indirect costs, project managers can create more accurate budgets, ensure better financial control, and make informed decisions that lead to project success. Understanding the difference between direct and indirect costs allows project managers to maintain transparency with clients, forecast future expenses, and stay compliant with regulations.

Ultimately, managing both direct and indirect costs effectively ensures that a project stays on track financially, meets its goals, and delivers results within the planned budget. Taking the time to factor in indirect costs from the start can prevent unexpected expenses down the road and contribute to a smoother, more successful project outcome.

Subscribe for Expert Tips

Unlock expert insights and stay ahead with TaskFord. Sign up now to receive valuable tips, strategies, and updates directly in your inbox.