Financial Control Inside Work Delivery, Not After

Learn why financial control must happen during work delivery, how control types manage cost in real time, and how integrated delivery improves cost management.

Financial control after delivery is like diagnosing a patient after they are already gone.

By the time finance reviews the numbers, the work is finished, the money is spent, and the decisions that caused the overrun are long past. Reports explain what happened, but they cannot change it. The damage is already done.

This is how many teams run delivery. Work moves forward based on speed and availability, while cost is checked later as a separate exercise. Small delivery choices accumulate quietly, and financial control arrives too late to influence them. This article explores why financial control has to live inside work delivery itself, shaping decisions as they happen instead of documenting the outcome afterward.

What Is Financial Control?

Financial control refers to the systems and practices organizations use to manage, monitor, and safeguard their financial resources. Its role is to ensure accuracy, reliability, and responsible use of funds.

The scope of financial control spans the entire organization and commonly includes:

- Financial planning and budgeting

- Expense authorization and approvals

- Risk assessment and mitigation

- Audits and financial reporting

- Asset and resource management

In the context of integrated work delivery, financial control should not operate only as oversight. When embedded into execution, it helps guide decisions while work is still underway, rather than explaining cost outcomes afterward.

The Role Of Financial Control In Work Delivery

In the context of work delivery, financial controls focus on how money is planned, spent, monitored, and reported while work is in progress. These controls ensure that delivery decisions remain financially sound as execution unfolds.

Key areas of financial control that directly affect work delivery include:

- Cash management: Controls over cash inflows and outflows to ensure funding availability aligns with delivery commitments.

- Budgeting and forecasting: Creating, monitoring, and adjusting budgets and forecasts as delivery conditions change.

- Expense management: Processes for recording, approving, and monitoring delivery-related expenses.

- Payroll and labor costs: Controls to ensure labor costs are planned and tracked accurately during execution.

- Financial reporting: Ensuring financial information is accurate and timely enough to support delivery decisions.

- Fraud detection and prevention: Controls that reduce the risk of financial misuse affecting active delivery work.

Why Financial Control Must Happen During Delivery, Not After

Financial control loses most of its value when it is applied only after work is delivered. At that point, costs are already incurred, commitments are fixed, and financial insights arrive too late to change outcomes.

What happens when financial control happens after delivery:

- Cost overruns are identified but cannot be prevented

- Budget breaches are explained rather than corrected

- Delivery teams lose the ability to make informed tradeoffs in real time

- Financial reporting becomes reactive instead of decision-supportive

To avoid these failures, financial control must operate across the delivery and project lifecycle, which is why different control types are applied before, during, and after execution.

Financial Control Types To Apply Across The Delivery Lifecycle

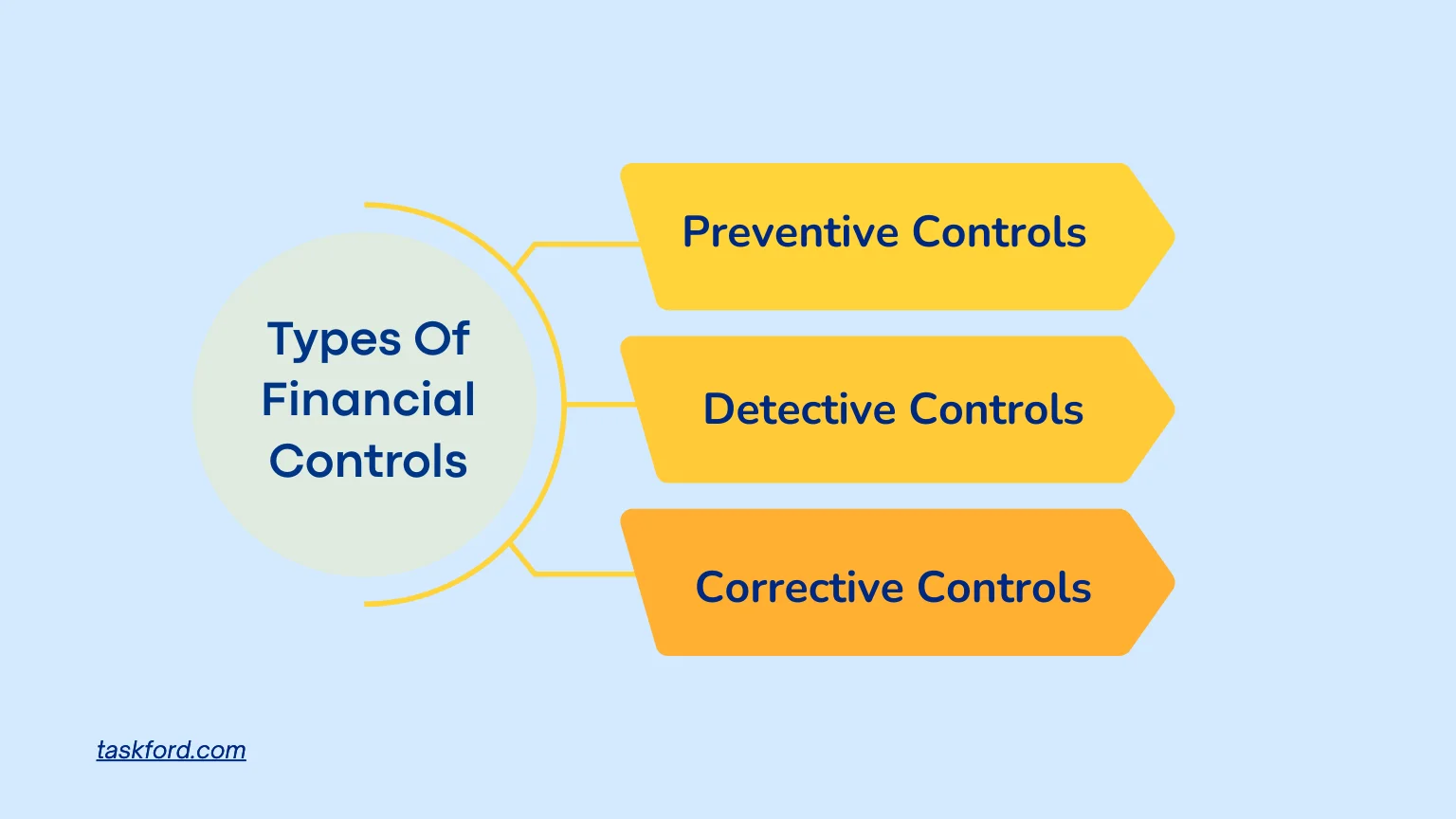

Financial control is commonly grouped into three types. In a delivery context, each type aligns with a specific moment in the lifecycle of work.

Preventive Controls: Before Work Starts

Preventive controls act as financial guardrails before execution begins. They help teams decide what should be worked on based on available budget and cost limits that fit the cash runway.

In practice, preventive controls help teams:

- Check whether funding exists before approving work

- Set budget limits for initiatives or delivery phases

- Prevent scope from expanding without financial approval

Example: Before development begins, a product team must select features that fit within an approved cost cap. Features exceeding the budget are excluded until additional funding is approved.

Detective Controls: While Work Is In Progress

Detective controls help teams notice financial problems as they are forming, not after delivery ends. They connect delivery progress with cost impact.

In practice, detective controls help teams:

- Spot when work is taking longer or costing more than expected

- See how delays, rework, or blocked tasks increase cost exposure

- Identify overspend risks early enough to respond

Example: Two sprints into delivery, actual engineering hours are 25 percent higher than planned due to integration issues, triggering a cost variance alert for the delivery lead.

Corrective Controls: When Risk Appears

Corrective controls are used once a financial issue is visible. Their role is to limit damage and regain control, not assign blame.

In practice, corrective controls allow teams to:

- Reprioritize or pause low-value work

- Adjust scope to fit financial constraints

- Reallocate resources to stabilize delivery

Example: After the variance is confirmed, the team reduces scope by postponing secondary features and reallocates effort to protect the core release within budget.

Core Mechanisms That Enable Financial Control

For financial control to function during delivery, several core mechanisms must exist. They ensure that financial decisions are made at the same time as delivery decisions, keeping execution aligned with both budget and strategy.

Organization-Wide Governance

Governance defines who is allowed to approve work, commit budget, and change priorities. When governance is clear, teams know:

- What decisions they can make independently

- When financial approval is required

- How tradeoffs should be evaluated

This prevents work from moving ahead based on assumptions or informal agreements that exceed financial limits.

Cash Inflow Controls

Cash inflow controls ensure that funding is available when work is planned to start. They help organizations:

- Confirm budgets before committing resources

- Align delivery timelines with funding schedules

- Avoid starting work that cannot be financially sustained

Without these controls, teams may deliver progress that the organization cannot afford to continue.

Cash Outflow Controls

Cash outflow controls provide ongoing visibility into spending as work progresses. They allow teams to:

- Track costs as they are incurred

- Identify budget pressure early

- Adjust scope, sequencing, or resourcing before overruns occur

This shifts cost management from a post-project review to an active part of delivery.

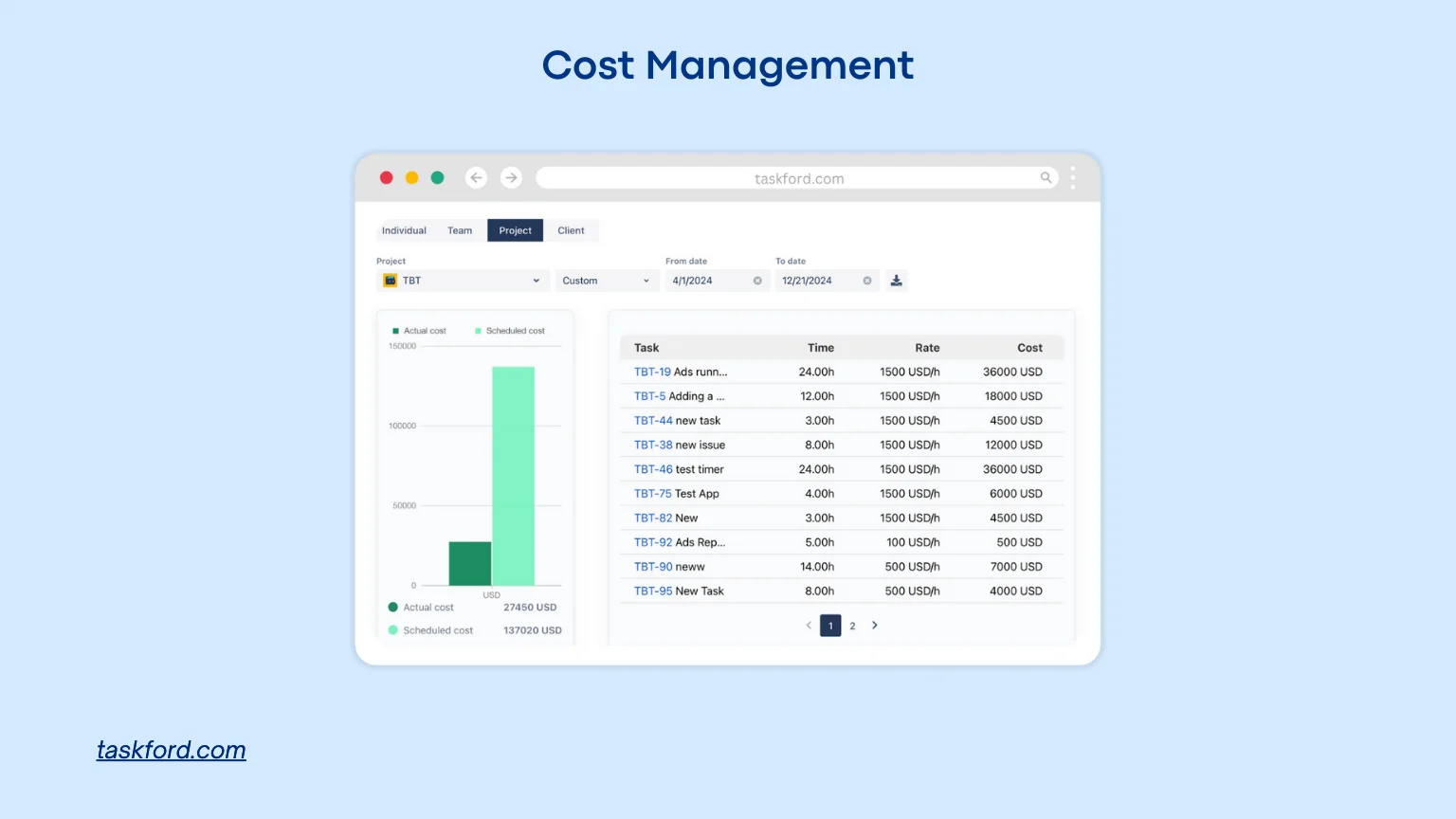

How TaskFord Supports Financial Control Inside Delivery

TaskFord, an integrated work delivery platform, supports financial control by embedding cost management directly into work delivery. Instead of reviewing costs after execution, teams gain visibility into cost exposure as work is planned and carried out.

By linking work, resources, and delivery ownership, TaskFord helps teams set financial boundaries early and monitor how effort and capacity translate into cost during execution. This makes overspend risks (Actual vs Scheduled Costs) visible while teams still have time to adjust scope, priorities, or resourcing.

Best Financial Control Practice

Applying financial control to work delivery requires disciplined practices

Comprehensive Risk Assessment

Organizations should systematically identify financial risks tied to delivery decisions, including operational inefficiencies, errors, regulatory changes, and market shifts. Risk assessment ensures controls focus on real vulnerabilities.

Balanced Mix of Control Types

Relying on a single control type creates gaps. Preventive, detective, and corrective controls work best together, covering the full delivery lifecycle.

Continuous Monitoring and Updates

Delivery environments evolve. Financial controls must be reviewed and adjusted as projects, processes, and external conditions change.

Staff Training and Development

Financial control depends on people. Delivery teams must understand how financial considerations affect their work and decisions.

Leveraging Technology for Efficiency

Technology, such as project management tools, supports financial control by centralizing data, automating checks, and improving visibility. Integrated systems strengthen the link between project management and cost management.

Conclusion

Financial control is most effective when it operates where decisions are made. In modern organizations, those decisions happen during work delivery.

By embedding financial control into integrated work delivery, organizations move from explaining overruns to preventing them. They improve cost management, strengthen project management, and protect outcomes while work is still changeable.

The shift is not about adding more controls. It is about placing financial control where it can actually influence results.

Subscribe for Expert Tips

Unlock expert insights and stay ahead with TaskFord. Sign up now to receive valuable tips, strategies, and updates directly in your inbox.