Burn Rate Explained: Definition, Types, and How to Measure Them

Discover what burn rate is, why it matters, and how to measure it step by step. Learn how tracking burn rate supports smarter cash flow and cost management.

What Is Burn Rate?

Burn rate shows how quickly a company is spending its cash. It’s usually measured monthly and helps you understand how long your current money will last before new revenue or funding comes in.

If a business spends more than it earns, the gap is its net burn rate. For example, if you spend $50,000 a month but only bring in $20,000, your burn rate is $30,000. With $150,000 in the bank, that means you have about five months to operate.

Simply put, burn rate answers one important question: How long can the business keep running with the cash it has today?

Why Burn Rate Matters

Tracking your burn rate helps you understand your financial situation at a glance. It shows how quickly money is going out and whether your current spending pace is sustainable.

Here’s why burn rate matters:

- Understanding financial health: Burn rate shows whether the business is living within its means or spending cash too quickly. If it’s too high compared to revenue, adjustments are needed sooner rather than later.

- Building investor confidence: Investors pay close attention to burn rate because it reflects how efficiently a company uses its capital. A manageable burn rate signals financial discipline and responsible growth.

- Supporting cost management: Knowing how much cash is burned each month supports better Cost Management by making it easier to spot unnecessary expenses and allocate resources more effectively.

- Estimating cash runway: Burn rate helps calculate how many months the business can continue operating with its current cash. This is critical when planning hiring, marketing, or expansion without risking a cash shortage.

Types of Burn Rate

There are two main types of burn rate: gross burn and net burn. Understanding both gives you a complete picture of how your company uses and manages cash.

1. Gross Burn Rate

Gross burn rate measures total cash spent during a specific period, regardless of income. It includes all operational costs such as salaries, rent, marketing, software, and other expenses. It answers the question: How much are we spending to keep things running?

Example: If your business spends $90,000 per month on payroll, rent, and marketing, your gross burn rate is $90,000.

Why it matters: Gross burn helps you see your total monthly spending and identify which areas consume the most resources. It’s especially useful for cost management because it highlights where potential savings can come from.

2. Net Burn Rate

Net burn rate considers both money going out and money coming in. It represents the net loss of cash over a given period.

Formula: Net Burn = Total Cash Outflow − Total Cash Inflow

Example: If your company spends $90,000 and earns $40,000 in the same month, your net burn rate is $50,000.

Why it matters: Net burn is a more realistic measure of financial sustainability. It shows how much cash you’re actually losing each month and helps estimate how long your cash reserves will last.

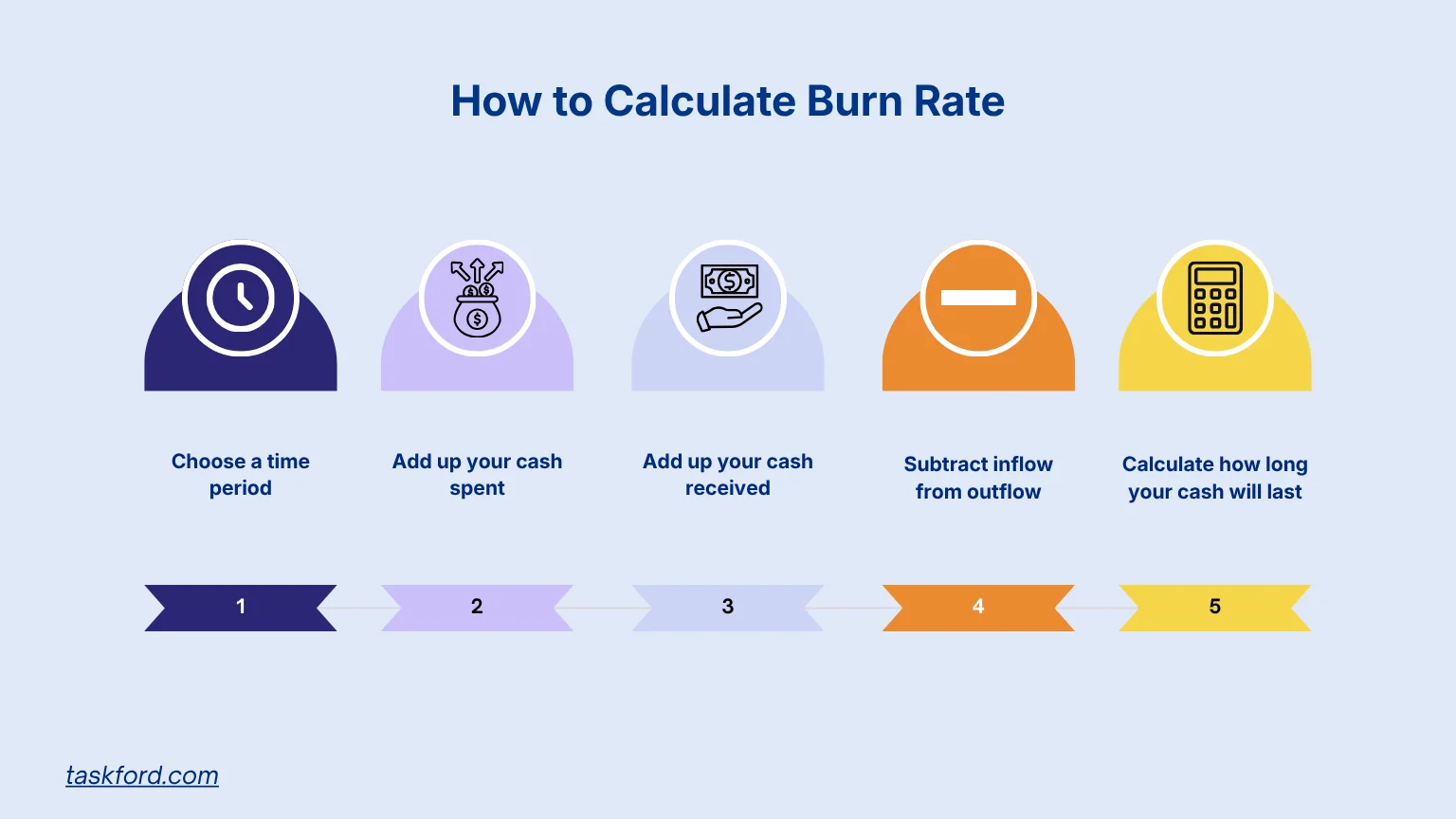

How to Calculate Burn Rate

Calculating burn rate isn’t complicated. It’s all about knowing how much money leaves your account and how much comes in. Follow these simple steps to calculate your burn rate accurately.

Step 1: Choose a time period

Decide which period you want to measure. Most companies calculate burn rate monthly, but weekly or quarterly can also work depending on your needs. Using the same period each time helps you spot trends and changes in your spending patterns.

Step 2: Add up your cash spent

Look at everything your company paid for during that period: salaries, rent, marketing, software subscriptions, and other expenses. Add them together to find your total cash outflow, which shows how much money has left your business.

Step 3: Add up your cash received

Now, total all the money that came in during the same time frame. Include revenue from sales, client payments, or other sources. This gives you your total cash inflow for that period.

Step 4: Subtract inflow from outflow

Once you have both numbers, subtract your inflow from your outflow. The result is your net burn rate, or how much cash you lost during the chosen period.

Example: If you spent $60,000 and earned $25,000, your burn rate is $35,000 for that month.

Formula Box

Gross burn (period) = Total Cash Outflow

Net burn (period) = Total Cash Outflow − Total Cash Inflow

Runway (months) = Cash on Hand ÷ Monthly Net Burn

Step 5: Calculate how long your cash will last

Now, take your total cash balance and divide it by your monthly burn rate. The result tells you how many months you can keep operating at your current spending rate. This is your cash runway.

Example: If you have $140,000 in the bank and a monthly burn rate of $35,000, you have about four months of runway left.

Quick Tip

Review your burn rate regularly. A monthly review helps you react quickly to changes in expenses, income, or funding so you don’t get caught off guard.

What’s a Good or Bad Burn Rate?

There’s no universal number for a “good” burn rate. It depends on your business model, growth stage, and funding situation. However, there are a few general guidelines you can keep in mind.

A burn rate that’s too high means you’re spending cash faster than you can replace it. This might be acceptable for a high-growth startup with recent funding, but it becomes risky if you don’t have a clear path to profitability.

A burn rate that’s too low could suggest underinvestment in growth. If you’re spending very cautiously, you might miss opportunities to expand, develop products, or reach new customers.

The key is balance. A healthy burn rate matches your company’s growth goals and funding timeline. It allows you to invest in progress without running out of money too soon.

How to Manage or Reduce Burn Rate

If your burn rate looks too high, don’t panic. There are practical steps you can take to manage or reduce it without hurting your business.

1. Review your expenses: Start with a detailed review of your biggest spending categories. Identify costs that don’t directly contribute to growth or operations, and see if they can be reduced or paused.

2. Delay non-essential hires or projects: If your cash is tight, focus only on roles and projects that directly impact revenue or product delivery. Expanding too quickly increases burn without guaranteed returns.

3. Renegotiate with vendors and suppliers: Many recurring expenses, like software, office space, or supply contracts, can be adjusted. Negotiating better terms can have a quick impact on your burn rate.

4. Increase cash inflows: Find ways to improve revenue without dramatically increasing expenses. That could mean shortening payment terms, upselling current customers, or adjusting your pricing strategy.

5. Track spending with software: Use financial tracking or project management tools to monitor where your money goes. When paired with cost management dashboards, you’ll see your burn rate trends clearly and spot potential issues early.

Moreover, you can also conduct a cost-benefit analysis on major expenses or planned hires to determine which investments are worth keeping and which can be delayed or reduced.

Common Mistakes When Measuring Burn Rate

Even simple calculations can go wrong if you don’t pay attention to details. Here are a few common mistakes to avoid:

- Ignoring one-time expenses: Big one-off costs (like equipment purchases or sponsorships) can spike your burn for a single month. Call them out separately so they don’t look like a new normal.

- Mixing up gross vs. net burn: Gross burn is total cash spent. Net burn is cash spent minus cash earned. Make sure everyone’s using the same one.

- Using outdated numbers: Burn rate changes fast. Use the most recent cash transactions, not old reports or last quarter’s assumptions.

- Confusing cash with accounting: Burn rate is about real cash moving in and out. Leave out non-cash items (like depreciation) and be careful with things that haven’t actually been paid yet.

Burn Rate in Project Management

Burn rate isn’t just for startups or finance teams; it’s also useful in project management. In this context, burn rate tracks how much of your project budget is being spent compared to the progress made.

For example, if your project uses half its budget but is only 25% complete, your burn rate is a red flag. It helps you identify overspending early, realign resources, and ensure the project stays on budget.

Monitoring burn rate in projects works best when combined with cost tracking. A good cost tracker helps project managers see which activities are consuming resources and allows for more accurate cost-benefit analysis when allocating budgets.

By combining financial burn rate with resource allocation metrics, project managers can balance spending and performance more effectively. Tools like TaskFord that integrate budgeting and cost tracking make this process easier and more transparent.

![]()

Conclusion

Understanding your burn rate helps you stay in control of your finances. It shows how efficiently cash is used, how long it will last, and whether spending supports your goals.

Tracking both gross and net burn helps you catch issues early and make better decisions. Combined with consistent cost management — and tools like TaskFord to track project costs — it becomes easier to maintain a balanced burn rate as you grow.

In the end, burn rate reflects how well you balance ambition with financial reality.

Learn more

- What Is Project Management: A Beginner’s Comprehensive Guide 2026.

- Project Cost Management: A Beginner’s Guide to Budgeting and Control.

- How Can Budget Planning Help Manage Resources - Best Tactics 2026.

Subscribe for Expert Tips

Unlock expert insights and stay ahead with TaskFord. Sign up now to receive valuable tips, strategies, and updates directly in your inbox.